Starting in the 2023-24 school year, students at South San Francisco Unified School District’s (SSFUSD) two high schools and three middle schools have the option to enroll in a personal finance class.

The new elective is designed to prepare students for college and career by helping them become financially literate.

SSFSUD’s Director of Innovation Jason Brockmeyer said the decision to offer these classes was made prior to the district’s most recent strategic planning process, which culminated last year with a description of the knowledge and skills the SSFUSD community believes students need to be successful after graduating from high school.

“Our initial thinking was trying to provide more options for students to continue their math progression,” said Brockmeyer.

Options for College Prep

Traditionally, high school students have enrolled in algebra, geometry, and precalculus to fulfill the district’s three-year math requirement.

Through the personal finance elective, El Camino and South City High students now have another way to fulfill that math requirement, while gaining practical skills designed to help them create budgets, manage loans, pay for college, understand taxes and insurance, and invest.

Through the personal finance elective, El Camino and South City High students now have another way to fulfill that math requirement, while gaining practical skills designed to help them create budgets, manage loans, pay for college, understand taxes and insurance, and invest. At El Camino High, teacher Nayeli Molina recently took the class on field trip to Trader Joe’s, where they were tasked with creating a meal plan for the week and pricing it out at the store.

Karie Mullassery, a teacher on special assignment who supports the development of math in SSFUSD secondary schools, said these are things students and teachers had both been expressing a need for.

“[High school] students were leaving and coming back and visiting teachers and saying ‘I wish I had learned how to read my paycheck or how to balance a check book. . .and how to budget,’ and a lot of teachers were getting that feedback, especially our math teachers,” Mullassery said.

Interest in the district’s new personal finance elective has been strong.

There are currently two sections of the class at El Camino and three at South City High.

Learning by Playing

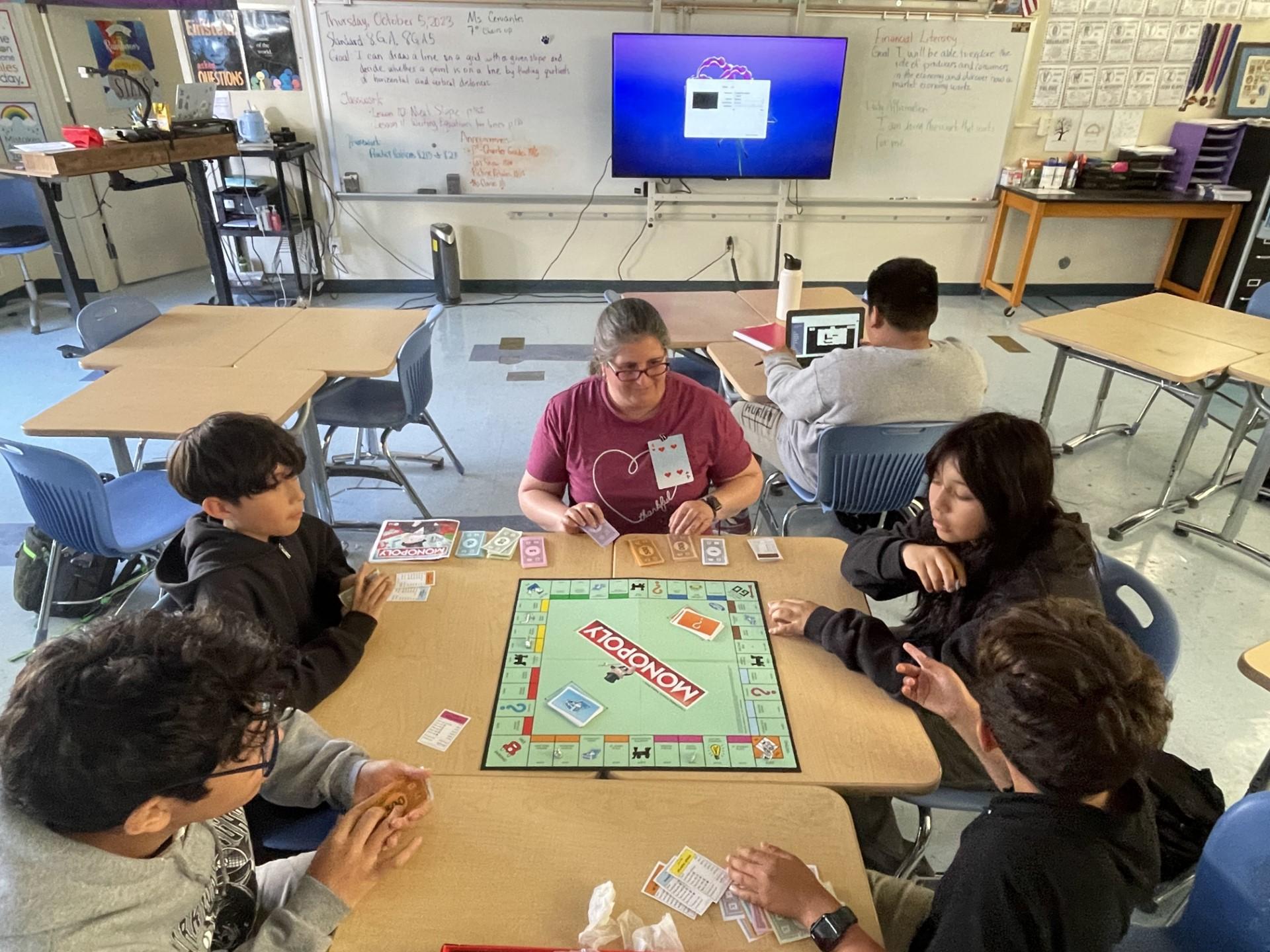

Meanwhile, middle school teachers are experimenting with a more simplified curriculum for younger students.

Liliana Cervantes is an eighth-grade math teacher who also teaches the personal finance elective to seventh and eighth graders at Parkway Heights Middle School.

She has been guiding students through a suite of interactive, digital, game-based, financial education courses from Everfi and reinforcing the concepts they encounter through project-based learning.

“They learn about stocks. They learn about savings accounts. They learn about getting a loan. They learned about everything that they’re eventually going to have to face when they grow up, so they’re learning it in a fun way, so when they get to that point, they have an idea,” she said.

Recently, her students created a timeline for their future, which involved sketching out ways to finance a college education as well as how to save money for a car or house.

“I like it, because I get to see what they are thinking,” said Cervantes.

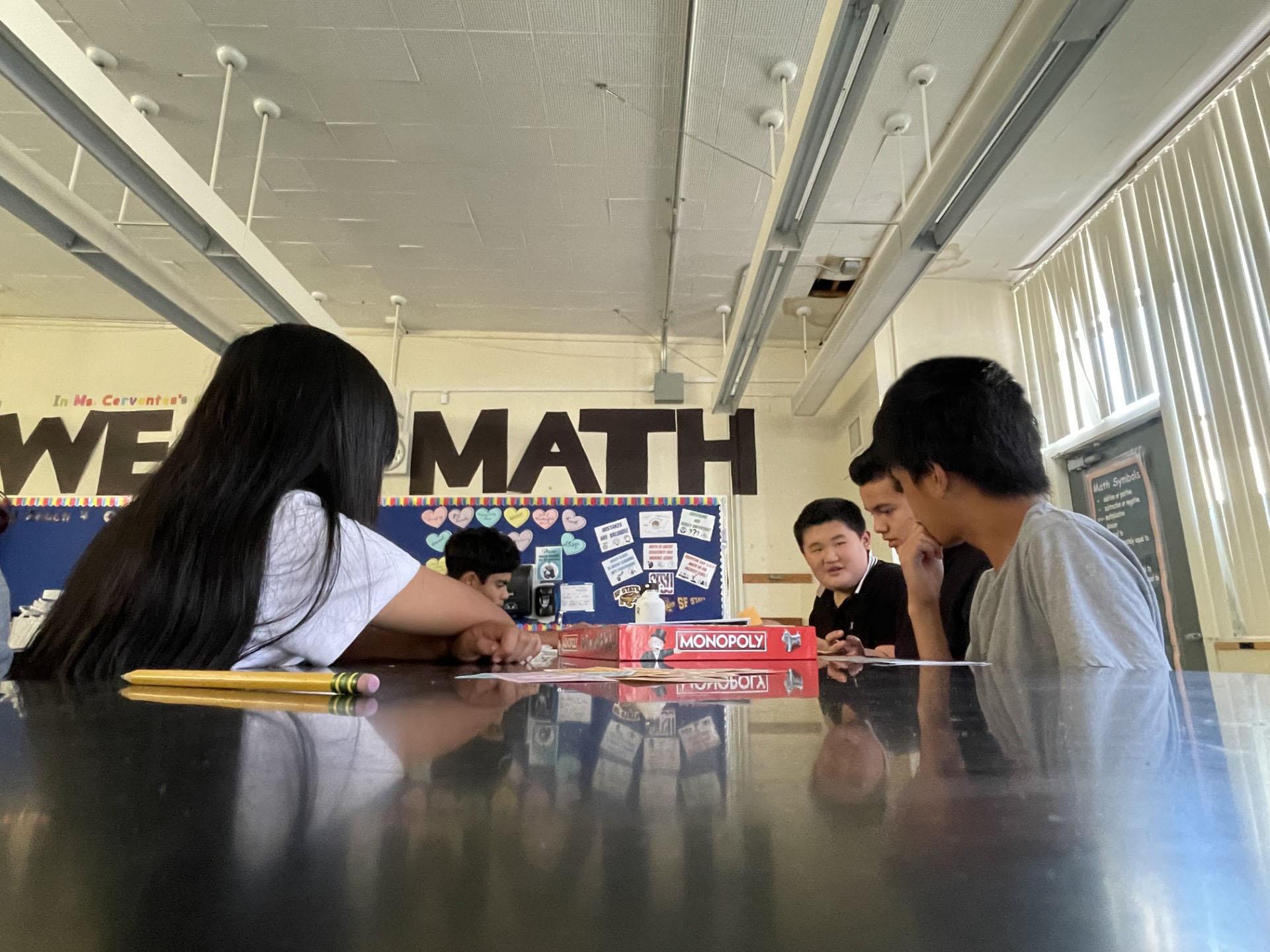

Today the class is playing Monopoly.

|

|

|

“I love the class. It’s one of my favorite classes here,” said Parkway Heights eighth grader Kian Tandavan. “What makes it fun is that everything you learn here you can actually do it outside of school: You can start saving money. You can start investing in things.”

Sixth graders sign up every quarter, while seventh and eighth graders sign up for an entire school year.

“Before this class, I didn’t know anything about saving accounts and managing money,” said eighth-grader Jhyllianne Millare. “Now that I take financial literacy, I know how this ties into real life.”

According to Brockmeyer, the personal finance curriculum is flexible, so the district can continue to expand and improve it by adding higher level concepts that can help students navigate the real world.

“I think kids find relevancy with it [finance],” said Brockmeyer. “There are so many layers that we can add into these classes outside of just basic interest rates and renting versus buying. Part of that financial literacy course at the high school level talks about livable wage. . .so it’s helping kids make decisions as they leave high school about what path they may take going forward.”